See What Policies Are Right for You

See What Policies Are Right for You

Our Commitment

Free Consultation

Committed to Excellence

Tailored Policies

Personalized Approach, Education Driven

Longevity Focused

Staying by your side for Years to Come

Join Our Family

I believe it's important to know who you are speaking to when it comes to making important decisions. I was born in Ohio, near the Football Hall of Fame (Go Ohio State Buckeyes!). When I was in middle school, my family moved to Florida. After graduating high school, I attended the University of Central Florida. I met my beautiful better half, and we are currently expecting our first child this fall (any helpful tips are appreciated!).

I pride myself on being education-focused, and I make sure to explain everything about health insurance so that you understand your policy. Obviously, health insurance isn't perfect. Having worked in the medical field, I know the chaos that can ensue while at the hospital or clinic. It's important to make sure you're covered so that you can focus on your loved ones, not on the bills.

Blog Posts

Unlocking the Benefits: A Comprehensive Guide to Employee Coverage

Breaking Down the Barriers of Employee Healthcare Costs - "Unveiling Tips and Tricks to Maximize Your Coverage"

In today's world, healthcare costs are skyrocketing, and it's more important than ever to make the most out of your employee coverage. But how can you ensure that you're not overpaying for your health insurance just because your employer offers coverage? In this exclusive article, we've got you covered with insider tips and tricks to help you take advantage of your employee healthcare benefits, including how to get coverage for your spouse and dependents, and how to save money on your healthcare costs. Don't miss out on this essential guide to breaking down the barriers of employee healthcare costs!

"Health insurance doesn't have to drain your bank account. With a little research and some smart planning, you can find a plan that works for you and your family while still keeping costs under control."

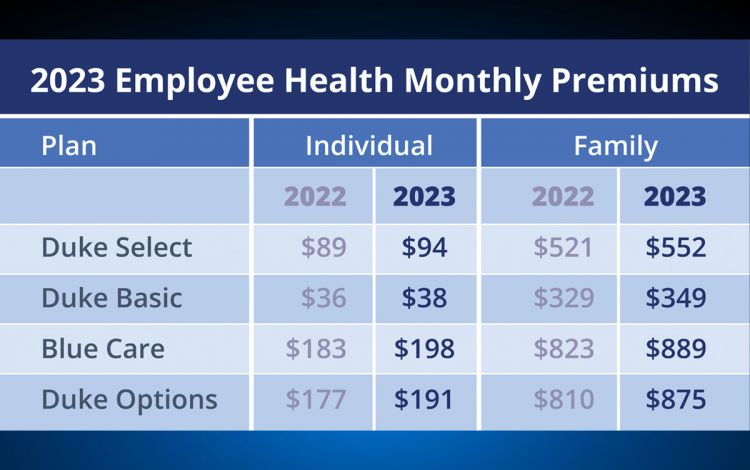

source: Duke Human Resources

Let's take a look at the image above. Notice how the cost for just the employee is a mere fraction of the price for family coverage? That's because your company has a group plan for its employees, which considers the medical spending of the entire group.

Now, if you work at a large corporation with thousands of employees, this might not make a big difference. But, if you work at a smaller business, this can have a significant impact on your wallet!

Here's an example to illustrate this point. Let's say your group plan premium is $500 per person. Your employer covers 50%, which means the cost to you is $250, or $125 every two weeks. Not too shabby, right? Wrong! The moment you add your spouse and dependents to the plan, you'll see those prices skyrocket! And, to make matters worse, your company doesn't offer to cover any portion of the premium outside of what the employee pays.

So, the bottom line is this: if you're a single employee, you're in luck! But, if you have a family to take care of, it might be time to start looking for a better healthcare plan. Don't let those high prices drain your bank account.

We've got some tips and tricks up our sleeves to help you navigate the treacherous waters of high deductible plans and sky-high premiums for family coverage.

First things first - if you're an employee with access to your employer's healthcare coverage, don't ditch it just yet. Sticking with your employer's coverage can actually save you a lot of money in the long run, if you keep the policy for the actual employee and move the rest of the family to a private insurance plan. Trust us on this one.

These plans can offer coverage based on your good health rather than relying on tax subsidies, which can be a game-changer for families looking to cut costs.

Speaking of tax subsidies, it's important to note that if you're offered employer coverage, you won't be eligible for a subsidy on the ACA Marketplace. So, it might be worth exploring other options, like asking your employer about a stipend. A stipend is a set amount of money that your employer offers to pay towards your healthcare coverage each month, which is still a tax write-off for the company. This can help reduce your out-of-pocket costs if you qualify for a private insurance plan.

For those of you who are 1099 contract workers, there's good news too! You can actually write off your health insurance costs under tax code HRA105 if your employer doesn't offer you a stipend. So, make sure you take advantage of this tax break to help ease the burden of healthcare costs.

In conclusion, don't let the high costs of family healthcare coverage bring you down. With a little research and some savvy planning, you can find a plan that works for you and your family without breaking the bank.

Our Mission

Our mission is to provide personalized health insurance solutions for individuals and families. We understand that health insurance is not a one-size-fits-all type of thing, and we're committed to finding the right plan that meets your specific coverage needs and budget.

At DC Health Advantage, we take the time to understand your unique situation and help you navigate the complexities of the healthcare system. Our goal is to help you take control of your health and your finances by providing customized plans that cater to your specific needs and budget.

We believe that everyone deserves access to quality healthcare, and we're passionate about finding the right plan that fits your individual needs. That's why we offer solutions not only on the ACA Marketplace (Obamacare) but also on private side health plans that qualify you based on good health. These plans come with deductibles as low as $0, low max out-of-pocket expenses, and PPO options.

We're committed to making a positive impact on the lives of our clients. Our mission is to empower individuals and families to take control of their health and their finances by providing personalized health insurance solutions that meet their unique needs. We're honored to be a part of your healthcare journey.

Don't wait any longer to get the coverage you deserve. Contact us today to receive a custom quote for your family. Let us help you take control of your health and your finances.

Frequently Asked Questions (FAQs)

ACA Marketplace (Obamacare) Vs. Private Insurance Plans

The main differences between the ACA (Affordable Care Act) marketplace and private insurance are:

Plan availability: The ACA marketplace offers a range of standardized plans that are required to provide certain essential health benefits, while private insurance companies offer their own range of plans that may have different benefits and costs.

Cost: The cost of ACA plans is often lower than private insurance plans, due to subsidies and tax credits provided to eligible individuals. Private insurance plans lower premiums than the ACA when subsidies and tax credits are not eligible.

Eligibility: ACA plans are available to individuals who do not have access to employer-sponsored coverage, while private insurance may be offered through an employer or purchased independently, however they qualify you based on good health.

Enrollment: The ACA has open enrollment periods (Nov. 1st- Dec. 15th) when individuals can sign up for coverage or make changes to their existing plans. Private insurance enrollment periods are year round.

It's important to carefully evaluate the options and costs of both ACA plans and private insurance to determine which option is best for your healthcare needs and budget.

Why is health insurance important?

Health insurance is important because it helps individuals pay for medical expenses that can be very costly. Without health insurance, people may be unable to afford necessary medical care or may end up with large medical bills that can cause financial hardship.

What types of health insurance are available?

There are several types of health insurance available, including:

Employer-sponsored insurance (employer pays a portion of your health insurance premium)

ACA Marketplace (Obamacare)

Private insurance (Qualified based on good health)

Medicare (for individuals over age 65 or with certain disabilities)

Medicaid (for individuals with low income)

Short-term health insurance plans (for temporary coverage, usually 1-3 months)

What is a deductible?

A deductible is the amount of money you are responsible for paying for medical expenses before your insurance starts covering costs. For example, if you have a $1,000 deductible, you would need to pay $1,000 out of pocket for medical expenses before your insurance coverage kicks in.

What is a copayment?

A copayment, or copay, is a fixed amount you pay for a medical service or medication. For example, you may have a $20 copay for doctor visits or a $10 copay for prescription drugs (keep in mind you may owe additional if deductible is not met).

Is the network important?

Yes, the health insurance network is an important consideration when selecting a health insurance plan. The network of providers is the group of healthcare providers (such as doctors, hospitals, clinics, and other healthcare facilities) that accept your health insurance plan. It is important to choose a health insurance plan with a network that includes healthcare providers you trust and can access easily. If you have a preferred healthcare provider, you should check if they are in the network of the plan you are considering. If you choose a plan with out-of-network providers, you may have to pay higher costs or even the full cost of the services.

How can I enroll in health insurance?

You can enroll in health insurance through your employer, the ACA marketplace, or through private insurance companies. Enrollment periods vary by plan and employer, so it is important to check the enrollment deadlines for the plan you are considering.

What is a pre-existing condition?

A pre-existing condition is a health condition or illness that existed before the start of a new health insurance policy. Before the Affordable Care Act (ACA), insurance companies could deny coverage or charge higher premiums for individuals with pre-existing conditions. However, under the ACA, insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions (Does NOT apply to private insurance only the ACA).

Can I keep my current healthcare providers if I switch insurance plans?

It depends on the plan and the providers. If you have specific healthcare providers that you prefer, it is important to check if they are in the network of the new insurance plan you are considering. If your providers are not in the new plan's network, you may have to pay higher costs or even the full cost of the services.

Get Inspired by our Customer Success Stories!

Questions? Book a Call

Whether you're looking to protect yourself, your family, or your business, I'm here to help! Contact me today to schedule a consultation and learn more about how I can help you secure the protection you need for a brighter tomorrow.

All rights reserved. This is not an offer to enter into an agreement. Information and programs are subject to change without notice.

DC Health Advantage

7055 South Kirckman Road, Orlando FL 32819

(407) 516-7177

custom_values.company_logo=https://storage.googleapis.com/msgsndr/N9vlhjwRQXG7M7a9XRy2/media/643591eb41ff7955c6119391.png

custom_values.headshot=https://storage.googleapis.com/msgsndr/N9vlhjwRQXG7M7a9XRy2/media/64359167a2d73e6b4b51c538.jpeg